We like to cover questions in our newsletters that come up regularly by our customers and this question is on our top ten list.

After an accident you don’t want to discover you’re covered by an insurance company with reliability issues.

Below are some regional research websites that have compiled information to help assess auto insurance companies in regional areas.

Complaint Index and Complaint Ratio for Colorado

The Complaint Index and Complaint Ratio are yearly compilations of consumer complaints done by the Department of Colorado Regulatory Agencies. The Complaint Index is the most revealing number; above 1.0 is below average and below 1.0 is above average.

Consumer Opinions

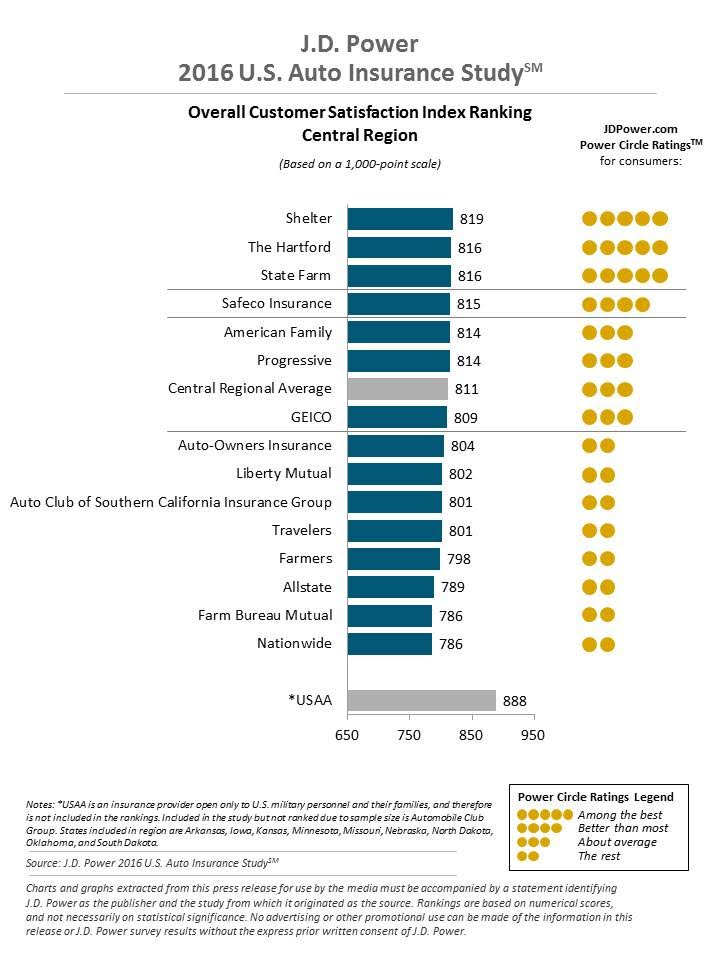

J.D. Powers & Associates ratings for auto insurance are a yearly regional customer satisfaction index rankings. Colorado is considered to be in the Central Region so scroll down to that graph.

Online Reviews

Search online for local reviews not national opinions. An insurance company may have a good rating in one particular market but a poor reputation in the Denver market. Be aware, people who have experienced problems are more likely to post comments than those who do not have problems.

Other Auto Insurance Considerations

- Coverages

- Costs

- Customer Service

- Discounts