According to an April 4, 2017 article in the Wall Street Journal, “Some insurers estimate that 25% - 50% of all vehicles on the road will need to have forward-collision-prevention systems before accident rates decline enough to offset higher repair costs.” Only 14% of 2016 models were ADAS equipped. As more of these products become standard equipment, the price will come down and the percentage of vehicles with ADAS will steadily increase, but with the average vehicle age currently 13 years, it will be many years until the percentage of vehicles on the road with ADAS reaches even 25%.

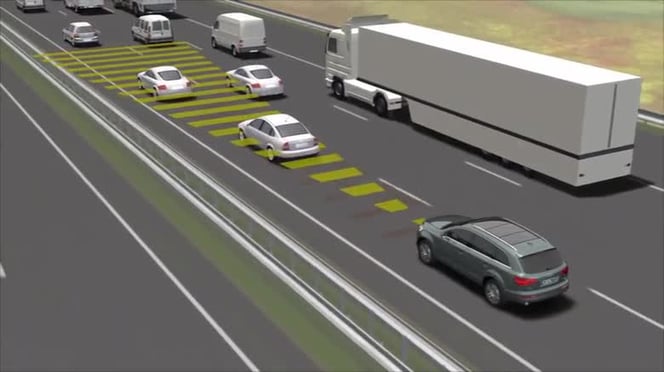

James Lynch, chief actuary at the Insurance Information Institute, writes in his blog that insurance companies adjust their rates after a technology has proved its worth on the road. At this point in time, these vehicles are more expensive to repair but haven’t shown a reduction in the frequency of accidents. Once that data is available, the company knows if a discount is warranted. To use the example of lane departure, an alarm beeps when the vehicle comes too close to the line, but this can become annoying and can be turned off. At this point, there is no way of knowing how effective this feature is.

People think insurance will be less with ADAS, but this isn’t the case yet. A Boston Globe survey of 1500 US drivers found that 55% said they would likely or very likely buy a semi-autonomous vehicle, but the leading reason they gave was lower insurance rates.

Regardless of insurance rates these safety features will be found on more and more vehicles and will keep occupants safer.